- Joined

- Apr 3, 2014

- Messages

- 8,966

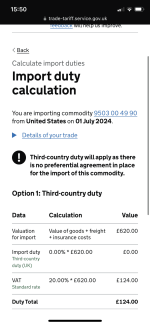

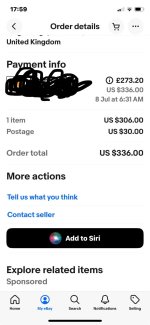

Hi everyone, just got an email from Royal Mail telling me I'm going to occur import tax for a vintage item because of the declared value. I purchased it on USA eBay, it's an ESB AT-AT driver MOC.

I've seen discussions on here about an exception code for such items, does this still work and if so can anyone help with it. Many thanks in advanced Adam.

I've seen discussions on here about an exception code for such items, does this still work and if so can anyone help with it. Many thanks in advanced Adam.